This is a complete guide to professional employer organizations (PEOs).

In this guide you’ll learn about PEOs – companies that can work with your organization to provide a comprehensive HR solution including payroll, benefits and human resource services through a business-to-business relationship called “co-employment.”

We’ll cover:

- What is a PEO?

- Why businesses use PEO services

- How PEOs operate

- What it means to be a certified PEO

If you want to learn what a PEO is and whether it’s a good option to help manage your company’s human resources (HR), this guide is for you.

Let’s begin.

Table of contents

Chapter 1

Intro to professional employer organizations (PEOs)

Are you bogged down by employee paperwork?

Is your payroll a pain in the neck?

Or maybe, attracting and retaining good employees is a constant struggle because your benefits aren’t up to par.

The good news: There’s help out there – it’s called a professional employer organization (PEO).

What is a professional employer organization (PEO)?

A PEO is an all-inclusive outsourcing option for your most time-consuming HR tasks and employer liabilities – those that are typically your sole responsibility, such as payroll and benefits.

When you join a PEO, it becomes the professional employer of your existing workforce, providing services and benefits (but not any staff).

As operating employer, you maintain control of all organizational decision-making, like managing your employees’ job functions and day-to-day tasks.

Which HR burdens get outsourced and which liabilities get shifted to the PEO depends on what you and the PEO agree to include in your contract, often called a client service agreement (CSA).

Now that you can answer the question, “What is a PEO?” let’s look closer at the benefits of using one.

Chapter 2

Why small-medium businesses use PEO services

HR challenges can be a real hindrance to your business’ growth. It’s easy to overlook key revenue-generating opportunities when you’re consumed with your HR to-dos.

Perhaps that’s why in a PEO arrangement, businesses have been shown to (NAPEO):

- Grow 7 to 9 percent faster

- Have 10 to 14 percent lower turnover

- Be 50 percent less likely to cease operations

When you join forces with a PEO, they can provide the you the infrastructure, resources and time so you can focus on growing your business.

3 advantages of using a PEO

By managing many of the HR jobs that you would usually outsource to multiple service providers, PEOs can help you spend less time managing various vendor relationships.

PEOs commonly help their client companies with services that:

- Increase operational efficiency

- Reduce risks

- Maximize the talent in your organization

Here are three specific advantages to using a PEO.

1. Provide better benefits and employee experience

A PEO can usually give you access to a wider range of benefits options, often at better rates, than what you could access on your own as a small or medium-sized organization.

Through a PEO, your employees gain access to big-business benefits and have a single point of contact for information and questions. This can help you recruit and retain better talent for your organization.

When you join a PEO, your employees may have access to:

Employee benefits

- Medical, dental and vision coverage

- A health care flexible spending account

- A retirement plan

- Life insurance

- Personal accident insurance

- Short-term and long-term disability insurance

- Adoption assistance

- Commuter benefits

- Educational assistance

Training and development

Many PEOs can offer you training and leadership development services for your employees, such as an online learning management system containing interactive courses and digital books.

A PEO’s training services may also include live or virtual training seminars.

2. Reduce risk

Through a co-employment relationship with a PEO – your company can effectively and efficiently mitigate a substantial portion of the risk and responsibility associated with having employees, including risks associated with things like:

- Correctly reporting, collecting and depositing taxes with state and federal authorities

- I-9 requirements

- EEO reporting and claim resolution

- Management of certain employee-related claims and provision of Employee Practice Liability Insurance (EPLI)

Most PEOs employ specialists who are responsible for monitoring many employer-related state and federal laws. Armed with this knowledge, the specialist stays abreast of constantly shifting laws, regulations and reporting requirements that impact the services the PEO provides to your business.

To help you reduce risks, PEOs often provide:

Workers’ compensation

Joining a PEO provides you with workers’ compensation insurance coverage. The PEO also manages and resolves injured employee claims in the event of an on-site injury.

To prevent injuries before they even happen, PEOs often offer loss prevention specialists who can review your safety practices and design return-to-work programs.

Payroll processing

- Paying your employees

- Payroll record keeping and compliance

- Online paystubs and W-2s

- Payroll management reports

- Garnishment and deduction administration

- PTO accruals

HR administration

Supporting your internal HR team, a PEO helps you manage your liabilities as an employer, providing:

- Employee handbooks

- New hire onboarding

- Termination assistance

- Leave of absence request management

- Employee relations support

- Drug testing services

- Liability management training

- Employment verification

3. Reduce costs

Not only do PEOs help their client companies save time. They can also help you save money through:

- Better hiring practices that reduce turnover

- Finding new ways to motivate your employees

- Making strategic plans for the future

And when you begin accessing HR services and benefits through a single source, you’ll have a better sense of your overall investment in your workforce.

Here’s what services PEOs can provide to help you reduce costs:

Recruiting support

A PEO can help you design the ideal recruitment process that fits your unique business. It may also work with you to:

- Develop job descriptions

- Conduct wage and salary surveys

- Improve your hiring managers’ interview and candidate selection skills

Performance management support

A PEO can help you design and conduct employee performance appraisals on a regular basis. In addition, to support ongoing performance improvement, PEOs often provide you with:

- Compensation resources and tools

- Supervisor coaching

- Assistance with job descriptions

- Reward and recognition program design

- Base pay structures

- Self-help tools and worksheets for variable and sales compensation structures

- Company climate surveys

Strategic HR support and planning

A PEO can help you develop a strategic HR plan that allows you to make HR management decisions now that will support the future direction and growth of your organization.

Chapter 3

How does a PEO operate?

The benefits can be quite compelling, but you probably still have more questions to ask about PEOs.

Let’s go over how PEOs work and what they do and don’t do for your business.

Understanding the co-employment model

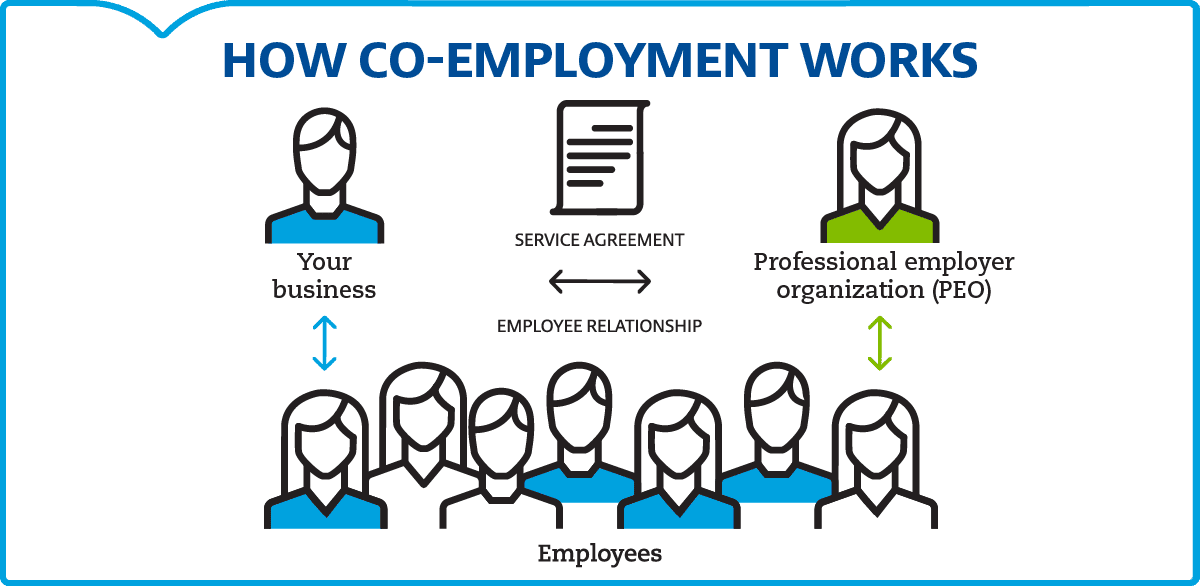

When you join a PEO, a business relationship called “co-employment” is created.

The co-employment relationship is a contractual agreement between you (the client company) and the PEO that allocates and divides up your employer responsibilities. In this agreement, your company’s employees (also called worksite employees) are employed by your company and by the PEO.

PEOs typically price their services as a percentage of payroll or as a flat monthly fee per employee.

There are a few misconceptions about PEOs that may exist due to the uniqueness of the co-employment agreement they enter into with clients.

So, let’s clarify what PEOs don’t do to help you see if it’s truly an option that would work for your organization.

What a PEO doesn’t do

1. PEOs don’t control your business.

Rest assured that a PEO is your co-employer only for the purposes you would expect based on your agreement (e.g., paying your employees and the other HR responsibilities specifically named in your CSA).

PEOs provide access to HR consultants whose guidance and advice you can call on when you need assistance.

They help manage your company’s employee-related administration and risks, but you maintain control of business and all operational decisions.

2. A PEO won’t replace internal HR staff.

PEOs align with your company’s existing HR department or staff to provide complimentary expertise, such as support in administering workplace policies and making shifts in company culture.

A reputable PEO will employ seasoned, certified HR professionals who have experience with various industries. And as a PEO client, their expertise is at your disposal.

This can prove invaluable when you’re faced with complicated HR situations or workplace improvement initiatives, such as:

- Increasing employee engagement

- Addressing conflict effectively

- Developing compensation programs that connect to business goals

Read more in our blog about how to keep your HR staff from freaking out about HR outsourcing.

3. Reputable PEOs don’t cause disruption to your workplace

Your existing employees will experience little-to-no disruption when you become a PEO client.

They’ll notice the PEO’s name on their paychecks, but they’ll pay the most attention to how their benefits package has likely been upgraded since your involvement with a PEO.

In addition, some PEOs offer online self-service options that allow employees to access and manage their personal information, benefits and pay stubs whenever they want.

Chapter 4

PEO vs. certified PEO

You may have come across a PEO that says it’s a certified PEO. Next, we’ll describe what this designation means.

The IRS has an established classification for PEOs – the certified professional employer organization (CPEO).

This certification process involves providing extensive financial information to the IRS, particularly about the PEO’s employment tax payment track record. Being certified by the IRS as a CPEO has certain federal employment tax consequences for both the CPEO and its customers and clients.

Let’s break down what that means.

When you join a PEO, from the IRS’ perspective, the PEO becomes your workers’ employer of record, and their wages are reported with the PEO’s federal employer identification number (EIN).

When a PEO isn’t certified, if employment taxes aren’t paid, the IRS can go after both the PEO and the client company for what is owed, even if the client already paid the PEO for these taxes.

But a CPEO assumes the sole responsibility for federal employment taxes for wages it pays to worksite employees.

So, one of the key benefits to using a certified PEO is greater peace of mind that comes from knowing your PEO is committed at a higher level and will be held accountable by the IRS for some of their responsibilities to your organization.*

But that’s not all you need to know about CPEOs. To learn more, read: What is a CPEO? Here’s your easy-to-understand guide.

*The IRS does not endorse any particular certified professional employer organization. For more information on certified professional employer organizations go to www.IRS.gov.

Summing it all up

Joining a PEO is a great way to break free from many of the responsibilities you must stay on top of as an employer that probably aren’t the reason you founded your organization.

Having another company step in as administrative co-employer helps you move HR obligations off your mental load once-and-for-all, knowing they bring as much care, expertise and dependability into the relationship with your employees as you do.

Benefits, payroll, HR compliance and many more services get streamlined into one, easy-to-manage vendor relationship with a PEO. You save time, find ways to be more efficient, and get strategic help with areas of your business that would be too costly or time-consuming to seek out if you didn’t have access to it through your PEO.

To learn even more about what a PEO is, how they work and what to look for in a good one, download our free e-book: HR outsourcing: A step-by-step guide to professional employer organizations (PEOs).